Travel hackers are a really weird bunch. After all, who in their right mind would spend their time chasing deals that earn 1000 miles here or a slim 1-2 points per dollar spent? This doesn’t even count for all the time we spend feeding various obscure routings into award flight searches in order to find that “perfect” redemption that includes the newest plane model or an amazing lounge stop (you know who you are).

As weird as we are, we get it. This is not for everyone. I’ve spent a bit of time writing about things that are more accessible to the average person, like earning cash back instead of miles or reducing hotel costs by buying loyalty points at a hotel chain. If that’s too much for you, even learning how to use Google Flights or some of the other tools we recommend can get you on the path to savings.

What if that’s still too much? Well then, this post is for you.

Table of Contents

Travel Hacking Is a Way of Life

Travel hacking roughly boils down to strategically taking advantage of deals and loyalty programs to get as big a discount off the retail price of travel as possible. Who’s to say this can’t apply to other goods and services? As with travel hacking, it’s all about knowing your tools…

Tool #1: Signup Bonuses

Sound familiar? Obviously, sign-up bonuses for credit cards are about as lucrative as they get, but many companies will happily offer you $10 or $20 to try out their product. Since the idea of a sign-up bonus is to get you to try out the service and hopefully use it long-term, you want to find products or services that you would be paying for anyway. If you don’t watch TV, don’t sign up for a Netflix subscription, even if they give you a few months free. That’s just asking for a recurring charge that you forget about.

Tool #2: Rebates and Special Offers

Be loyal only to those who give you the best deal.

While this is terrible advice for (most) relationships, in the supplier-saturated world of the internet and mobile phones, it’s pretty easy to find product or services that are fungible with one another. Uber too expensive? Try Lyft. Amazon Prime not cutting it for you? Try Google Express. Everyone wants your business and will offer you promotions that compete with each other. Use this to your advantage.

Moreover, just as the retention call (threatening to cancel in hopes of having an annual fee waived) can is useful in mitigating the cost of credit card annual fees, so too can they be useful for utilities or other recurring services. I have countless friends who have saved hundreds of dollars a month by threatening to cancel their service and having their introductory promotions renewed. Try it some time (and be ready to actually cancel).

Tool #3: Rewards Programs

Although typically we conflate travel hacking with awards flights and hotel bookings, loyalty programs are just one part of a travel hacking strategy. For some, it’s not worth the time or effort, but for others, it can the main component of their strategies.

Whether or not you think you’ll use a loyalty program, if a company offers one, you should sign up. Unsubscribing from the emails is easy enough, and you leave the option open to utilize the rewards in the future if you so choose. For no extra effort, it can pay dividends.

Tool #4: Portals

A few percent here or there can add up, especially if you’re paying for electronics or making other large purchases online. Airlines and other companies will offer you a certain percentage of their referral fees for each purchase you make using their links, so it pays to check Cashback Monitor for the rates before you make a purchase. (Make sure you have ad-blockers turned off in order to improve your likelihood of the portal tracking.)

Case Study: Boxed.com

The motivation for this post is actually an offer that’s still ongoing at Boxed.com. Boxed.com attempts to bring the bulk-buying experience of Costco or Sam’s Club to consumers, minus the membership fee. In practice, you end up getting bulk-quantity items for a slight markup to retail relative to buying at somewhere like Target or your local grocery chain, but obviously, we’re not here to pay retail, let alone above retail, for our household goods.

The Sign-Up Bonus: $15 off $60 or More

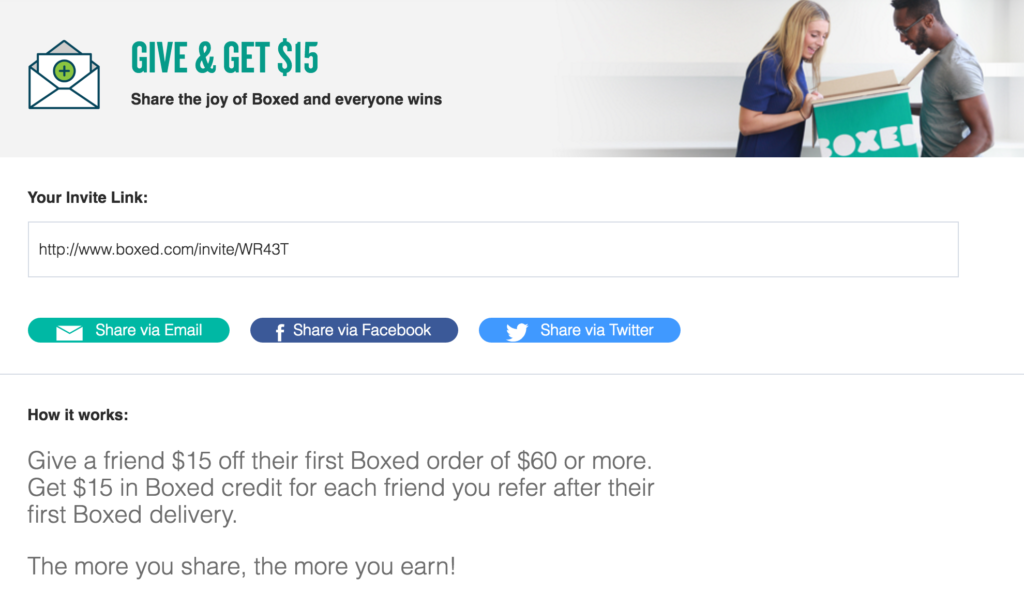

Boxed.com offers a referral program whereby you get $15 off your first purchase of $60 or more, along with free shipping. (As far as I know this is as good as any other public sign-up channel, so if you want to help us out, please use our referral link here). That’s a 25% savings off the bat, although we do have to bear in mind that we’re starting with some markup.

The Special Offer: Amex

My rough expectation is that Amazon sells household goods for about 25% markup, and the things I was interested in buying at Boxed.com were a bit cheaper than Amazon’s price, so with the $15 off $60 I’m still only break-even relative to buying the goods in store.

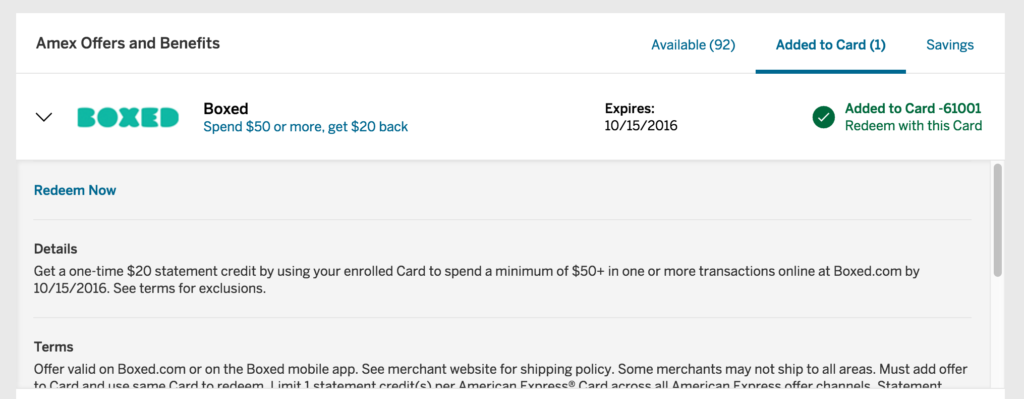

Except — for those with an American Express card, you can get another $20 off a $50 purchase by enrolling in an Amex Offer for Boxed.com. For those unfamiliar, Amex Offers are a rebate program offered by American Express that operates independently of merchant discounts, so they work in addition to discounts you might already get. Doctor of Credit has a good reference guide to Amex Offers if you want to learn more about them.

Where does that leave us? If we can spend $50 AFTER our sign-up bonus, then we can get another $20 off our purchase. More specifically, if we spend $65 or more, we can get a $35 discount. Obviously, the best percentage discount of 54% off comes from an order of exactly $65, so the close to that, the better.

Now we’re getting somewhere. Can we do better?

The Rewards Program: Boxed Bold

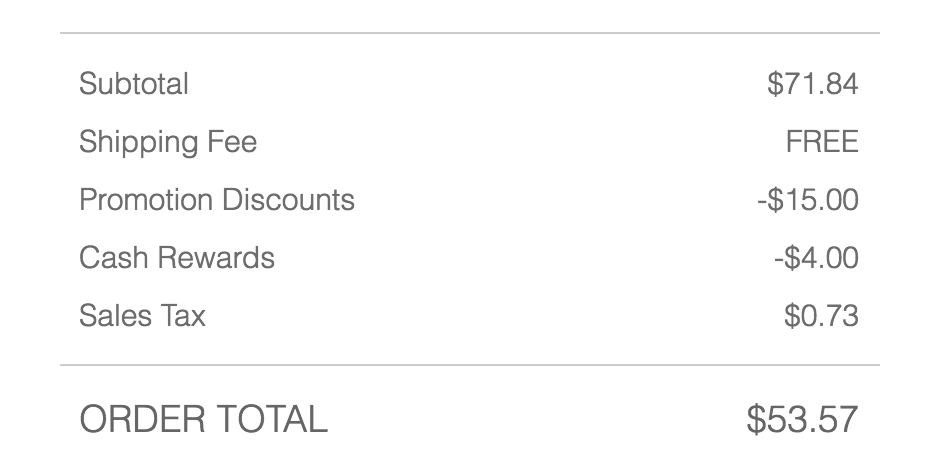

Boxed offers a rewards program giving 3% credit toward future purchase, with an extra bonus of $2.50 after your first purchase. Cashing out is as easy as checking a box to apply the rewards to your order.

The Portal: TopCashBack

For first-time purchasers, most of the main-stream portals offer a whopping 8% cash back on your first purchase (1.5% on subsequent ones). That’s another $4 savings off your initial $65 purchase (usually cashback is only earned on the amount AFTER discounts are applied), which I’ll happily take for things I’m buying regularly. With portals it’s best to use a single one regularly in order to reach payout thresholds, hence my using TopCashBack, but there are plenty of others offering the same bonus. As always, you can look up rates with Cashback Monitor.

“Extreme Stacking”: Travel Hacking, for Normal People

After starting with a $71.84 order, my net cost will end up being a measly $31.42. Obviously, I won’t be able to sustain that discount after I’ve used up all the bonuses (note that you’re allowed two accounts per household) and offers, but at that point, I’ll just move on to the next service (Google Shopping Express comes to mind).

I’ve learned a lot from my experiences travel hacking, and as I get more serious about my savings and financial health, it’s good to know that my ‘skills’ are applicable to other areas of my life. And heck, if l explicitly earmark some of my discounts for future travel, I guess it’s all one in the same.

For more on “Extreme Stacking,” see this FrequentMiler page here. His will largely be points and miles/reselling focused, but the same general principles apply no matter what you’re buying.

Happy stacking!

Update: Esther found that Boxed.com also offers free samples with every order. Find them here.

Just wanted to point out that Ibotta has boxed at 15% cashback