Recently I’ve gotten into margin lending as a form of leverage. Why would you want to do that? This great post from Mr. Money Mustache goes into how it works and some reasons why you might want to do it. But mostly, the interest rates are incredibly low (a base rate of around 1.1% which adjusts based on interest rates), so it’s a fast and cheap way to get liquidity to put to other uses. To me, I consider it safe as long as you aren’t using it to spend or invest beyond your means, and are just taking advantage of the low interest rates. For example, to get liquidity from your equity without selling it off and incurring capital gains taxes, or to get liquidity during a market dip to buy at the dip without selling existing equity. Personally, I am using margin lending to earn a much higher interest rate (19.5%) with Anchor Protocol, or the other day I needed to meet a capital call and funds were being too slow to transfer from other sources.

The post I linked above already goes into a lot of details about how the process works, so here are some practical tips. First, in order to even get access to margin lending with InteractiveBrokers, your account type must be a margin account. You can switch this from the Account Settings page:

You probably want a regular Margin account, not a Portfolio Margin account, as it’s much easier to calculate how much margin you have with a regular margin account (50% of your equity value). InteractiveBrokers has a page explaining the details of both types of margin accounts, but Portfolio Margin seems fairly complicated to understand. It takes a few days to switch account types, so keep that in mind.

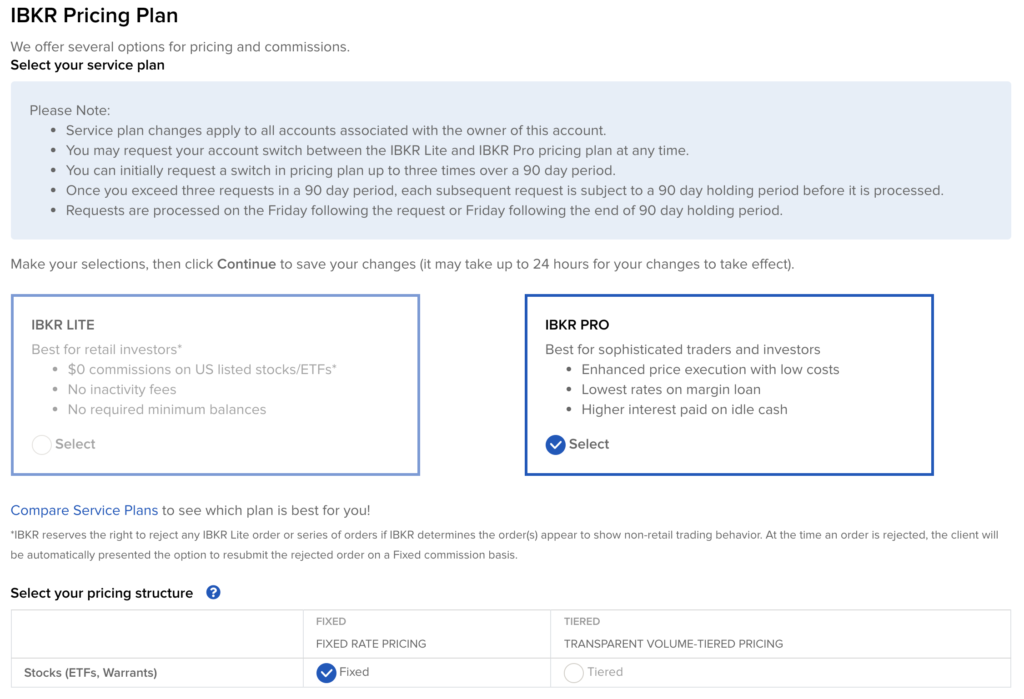

Another thing is you should have a IBKR Pro account, as that will make the margin rates much much cheaper. The downside is that trades aren’t free with an IBKR Pro account (though are fairly low, starting at $0.005 a share with a $1 USD minimum for the Fixed pricing structure, unless it is a no-fee ETF.) You can also switch this on the Account Settings page. It will take a few days to switch your pricing structure as well.

How do you actually take out a loan though? I was searching all over for the function, but couldn’t find it. Turns out it actually works as a withdrawal of funds to an external account, which makes your settled cash balance negative. You can access this from the main IBKR page under Transfers Funds -> Withdrawal. Transfers of the form of either ACH or Wire are free once a calendar month, otherwise a small fee applies.

Another small tip, h/t to my friend Ninad: if the funds you are taking out a loan from are new transferred in, you need to wait 30 days to withdraw them to an external account. However, you can still trade with margin during this time.

How does your account work with a negative settled cash balance? At regular periods, interest will accumulate on the negative settled cash balance. This goes into the cash balance, it isn’t something that you have to pay off regularly unless you want to. If you earn dividends, sell stock, or transfer in money, all of those offset the negative cash balance.You don’t get margin called unless your negative settled cash balance goes higher than the amount you are allowed to borrow, which is generally 50% of your portfolio. Thus, try to keep a healthy margin between your actual borrowing and maximum amount of borrowing!

I hope these tips help people with their financial goals!

Thanks for sharing the details. I’ve been meaning to get into this but haven’t gotten around to it yet.

Mind sharing how you’re getting funds into anchor? I have a little bit feel like I’m consumed by fees whenever I move funds over. Thanks! Great post!

The onramp I’m using is: move funds to Coinbase, buy UST with USD (fee of 0.01%), send the UST to KuCoin, then send to my Terra Station wallet. Pretty minimal fees that way.