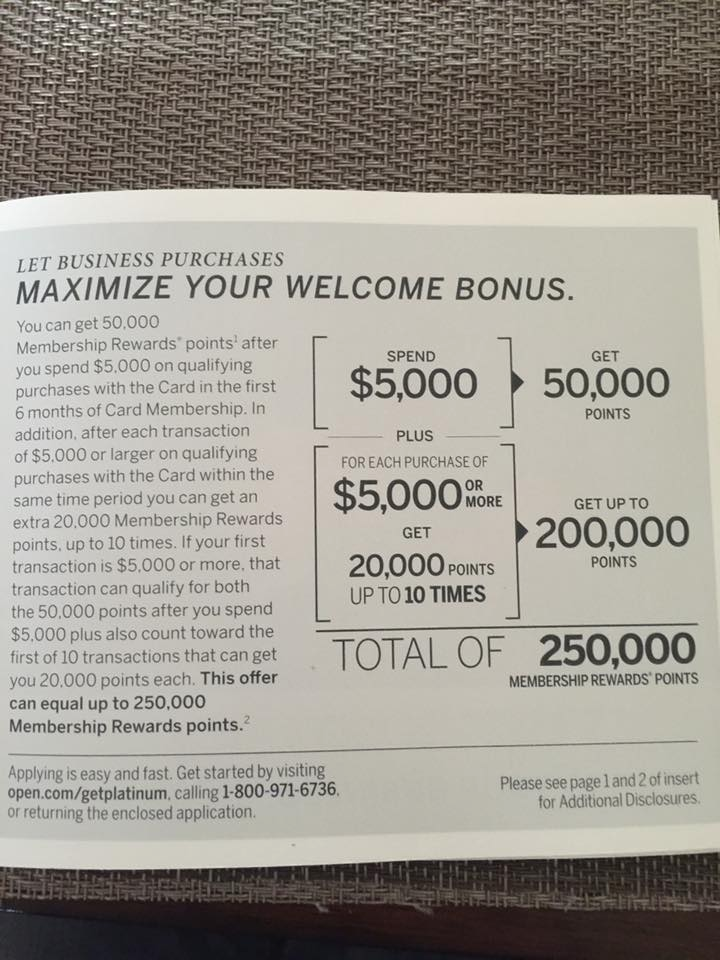

For those of you that have been following the blogosphere lately, you may have seen headlines like “Highest Offer I’ve Ever Seen” or “Best Amex Platinum Offer Ever.” When you click through, you are presented with the following (highly highly highly highly) targeted offer, first reported on r/churning on Reddit:

250,000 Points!!! That’s a lot of Points!!

Yes, it is. But how does it actually work? There are two parts:

- A standard spending offer of 50,000 points after $5,000 spending in six months

- 20,000 points for each PURCHASE of $5,000 or more made in the first six months, up to 10 purchases.

If you only hit the first $5,000 in spending, it ends up being a pretty run-of-the-mill offer — certainly not worth it given the once-per-lifetime limitations Amex recently applied to its signup bonuses.

On the other hand, if you max it out, completing exactly ten purchases of $5,000 with no other spending (NOT ADVISABLE unless you’re looking for a financial review from Amex), you’d wind up with 300,000 Membership Rewards points after having spent $50,000. That’s a two round-trips in business class to most places in the world from the U.S.

How does it compare to other offers? Well, the highest we’d previously seen was for 150,000 points after $20,000 spend (170,000 points total), which led to the (now infamous) $20,000 reselling challenge. There are also frequent mail offers for 100,000 points after $10,000 or $15,000 spend. Neither of these come anywhere close to the 300,000 points promised by the new offer, but then again, neither have as high (or strange) spending requirements.

A different take on sign-up bonuses

Typically we view sign-up bonuses as lump sums, since that’s how they’re paid out. However, recently, we’ve seen more and more introductory offers for credit cards with tiered bonuses, the British Airways Visa and Virgin Atlantic Visa Signature card are the first that come to mind.

Given that tiered bonuses are designed to create regular spending habits by withholding instant gratification, I expect they will become the norm rather than the exception. For example, Discover, who was never offered a lump-sum bonus, recently announced that they will continue their “double rewards” offer for customers in their first year of holding a card as opposed to switching to the more traditional model.

We tend to value and think of these cards differently than other cards, as the spending gets broken down incrementally into tiers rather than as a collection of lump sums. Frequent Miler, for example, did an analysis of the Virgin Atlantic card and broke down each tier of spending by the additional miles earned per dollar of spending.

Why don’t we treat all sign-up bonuses this way?

Yes, of course, because of the back-loaded nature of the bonuses, we don’t actually get the points until we reach the given spending thresholds, but fundamentally, a more ‘standard’ offer of 50,000 (points, miles, whatever) after $3,000 spending is no different than these tiered offers, with the exception of that fact that there’s only one tier. In this case, we’d get a bonus of 16.6 miles per dollar spent, which is really high and almost certainly worth our spend.

Thinking of sign-up bonuses in this way allows us to do a better apples-to-apples comparison of offers. Why? Well for one, we don’t have to treat tiered offers any differently from normal offers. The 250,000 Amex Platinum offer (ignoring the weird transaction size requirement) just ends up being a bonus of 5 additional points per dollar spent up to $50,000, for a total of 6 points per dollar spent. If your opportunity cost were 2%, that’s totally worth it. On the other hand, if all your spending were at grocery stores where you get 5%, it might be a little less clear.

Retention offers also fall nicely into the same line of thinking. After all, many retention offers take the form, “for the next N months, spend $X each month to get Y bonus points.” Is it worth it? Well, you tell me. I got an offer for 1,000 bonus AA miles after spending $1,000 in a month for the next six months. That’s a bonus of 1 miles per dollar spent, for a total of 2 miles per dollar spent. Believe it or not, I passed on the offer (well, it’s attached to the account whether I take advantage of it or not), because my opportunity cost compared to a 3% card is too high.

Obviously, this way of thinking about sign-up bonuses pre-supposes you can and will meet the spending for each tier. That is, getting 10,000 points after spending $1,000 is NOT the same as getting 10 points per dollar up to $1,000. So maybe you discount a lump sum slightly when it to your standard spending rewards or to another offer that doesn’t have a tiered component, but the rough logic still applies.

Going forward, and particularly as a lot of good offers dry up, I’m going to look for offers that provide a high bonus on my spending with a high cap on the number of points I can earn. As long as I were confident I could hit the $50,000 in spending, I would happily take the opportunity to get 6 Membership Rewards points per dollar. Frankly, I’d even take a bonus for 4 points per dollar if it applied over $100,000 spend. If I weren’t confident in being able to meet the spending, however, it would be worth taking a smaller cap for a (much) higher per-dollar return (e.g. the 150,000 point offer after $20,000 in spending).

How do you think about bonuses? Has your strategy shifted lately?

Happy hacking!